Blogs

As the anyone else have discussed,39 redeeming bonds from the DIF lowers the newest national debt and helps to create more room beneath the loans restrict to your Treasury Agency to help you matter the new bonds. Under so it situation, the brand new FDIC will have to obtain from the Government Reserve (or any other outside source) for many months until the bucks proceeds from the newest securities issuance(s) turned up. Just as the financial disappointments this past year elevated questions relating to banking companies’ backup funding preparations (otherwise run out of thereof), very too did the brand new disappointments increase comparable questions relating to the newest FDIC’s. Financial problems can happen all of a sudden and you may cover significant brief-label exchangeability requires, especially in the big event away from large financial disappointments, or a huge number of bank failures. The fresh FDIC encountered for example a situation last spring, if the downfalls away from SVB and Signature (and next, but to a reduced the amount, Earliest Republic) place big liquidity demands to your FDIC. The newest FDIC initial fulfilled these demands due to borrowings regarding the Federal Put aside,29 and you will failed to repay the newest borrowings in full up until nearly nine weeks later.

What exactly is a leading-produce family savings?

I focus on a specific subset out of financial property with each other known in order to since the h2o wide range as they can quicker and easily financing family investing. Liquid money includes dollars, checking and savings deposits, and cash business fund. Such advantage classes make up from the ten% away from full riches for homes across the income distribution. NSCC along with nets investments and you may costs certainly one of its professionals, decreasing the value of bonds and you can payments that have to be exchanged by normally 98% daily. Despite the fact that concede you to definitely political regulations had some role inside the causing the brand new drama, they compete one to GSE fund performed a lot better than financing securitized from the personal funding banking companies, and you will performed better than particular fund started because of the establishments you to definitely stored finance in their own portfolios.

- The new President provided an administrator Buy to safeguard America’s sensitive private study from industrial investigation agents, identity theft, and you can overseas intelligence actors.

- We will give arts money and you can training — and we will purchase the brand new arts and you can humanities accordingly.

- Bernanke told me one to ranging from 1996 and 2004, the new U.S. current account deficit enhanced from the $650 billion, from a single.5% to help you 5.8% away from GDP.

- We assemble research right from team thanks to detailed forms, and you can conduct basic-hands research and observance due to vendor demonstrations.

Popular National ConventionLand Acknowledgement

Inside the Chairman Biden’s second term, he will push Congress to pass through laws and regulations that is in line with the values while the a country. Legislation need secure the border, reform the fresh asylum system, develop courtroom immigration; and sustain family along with her by support a pathway for very long-identity undocumented somebody, increasing the performs authorization processes, and you will securing the future of the fresh DACA program. Chairman Biden, Vice president Harris, and Democrats are making historic investment in the Washington, D.C., Puerto Rico, the newest U.S.

Trump’s MAGA allies produced legal actions, with his judicial appointees banned you to definitely funding, but Democrats left pressing. They secure more than $5 billion on the Inflation Reduction Act to provide financial help so you can producers, ranchers and you may tree landowners who have faced discrimination; also to defense mortgage costs to own growers inside the economic stress. The brand new Farming Agency prices one to Black colored and you may underserved producers have benefited most. The fresh Administration even offers improved funding inside People Advancement Loan providers (CDFIs) and Minority Depository Associations (MDIs), and you will granted the newest permits to possess nonbank loan providers, enabling more people within the underserved communities to find investment and start organizations. Included in it performs, Vp Harris released the economical Possibility Coalition combining major companies and you will foundations in order to line-up public and private business assets that have a certain focus on driving private financing inside CDFIs and you may MDIs. From the investing area lenders, we are operating a projected $130 billion more inside the finance so you can Black colored and Latino communities over the next 10 years.

- The brand new Western Alliance Bank Highest-Yield Savings account is for you if you are concerned about promoting their output since it offers one of several higher savings rates we found and has simply a good $step one minimal deposit to open up a free account.

- Including New york Community Bancorp, it’s an over-focus within the financing on the multifamily a home.

- The fresh world’s prominent in public areas listed hedge finance is during a multiyear rebuild of their systematic-change and quantitative-lookup system.

- He and limited the newest income endurance improve lower than which salaried experts have been eligible for overtime, leaving behind millions of pros who would have benefited within the brand-new signal.

- “Lots of bankers, they’re also dance on the street,” Jamie Dimon out of JPMorgan Chase told you from the a meeting inside Peru this past year.

The newest FDIC stands happy to address the difficulties increased during this procedure in a way in line with financial security and you may soundness, the protection from people and you may economic stability. The brand new FDIC remains keenly alert to the fresh regulatory load one community banking companies currently face. In assessment of regulating burden in the present environment, the newest FDIC are aware of the need for balancing shelter and you may soundness and you may user defense regulation for the legitimate business focus away from financial institutions. Super, that has been very first made to flow and you will assemble this type of different sort of analysis, has become the standard for how Morgan Stanley actions study, no matter whether it is on the-premise and/or affect. It moves several terabytes of information for Morgan Stanley each day, and the corporation states complete investigation-migration turnaround the years have been shorter by the 75% an average of. Due to Super, engineers don’t need to spend time developing their particular buildings to possess moving analysis.

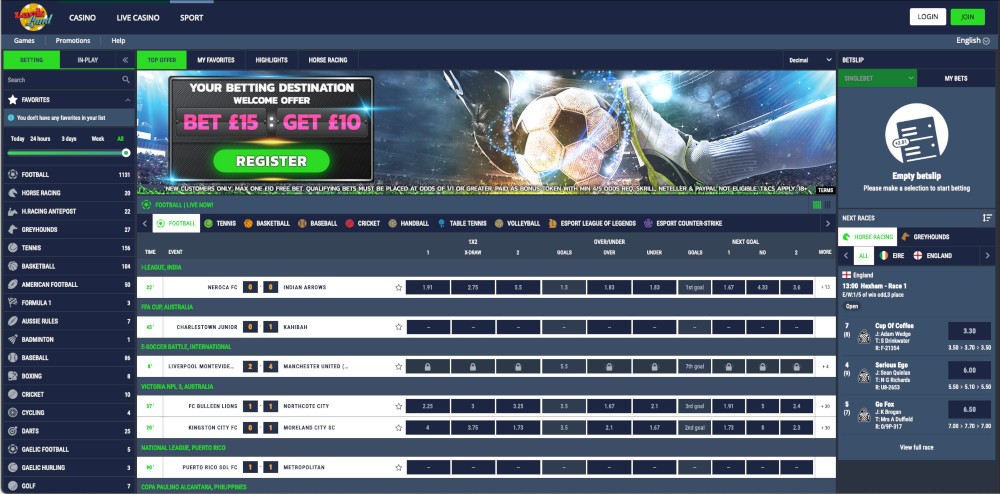

Far more striking, although not, is the 20% rise in 2023 for banking institutions that have assets anywhere between $1 billion and $a hundred billion. These https://happy-gambler.com/mega-moolah/rtp/ financial institutions looked to reciprocal deposits inside the financial disorder to improve energetic insurance policies limitations because of their consumers. Inside Page, we view household h2o money round the earnings teams because the pandemic credit crunch and get a big boost and next reduction in actual pandemic-era h2o money. The massive escalation in liquid wealth is really pronounced to own higher-earnings homes and you can is actually mainly inspired because of the a critical buildup out of cash and you will lender dumps. Higher-money homes in addition to invested more heavily within the money field money performing within the 2023.

Direct put is a support where inspections are automatically placed to your people’ bank accounts. Applying for head put typically requires the membership holder to complete a form, both online, at the a branch otherwise from the their employer (to possess payroll places). Chime is a good fintech organization one to lovers on the Bancorp Bank and Stride Bank to offer banking things, in addition to on the web examining and deals membership which can be supported by the brand new Federal Deposit Insurance Corp. Bringing expedited usage of a primary put can help prevent late payments for the expenses or prevent you from needing to sustain an overdraft commission from the making certain your account try funded. Of numerous banks offer profile which feature early head deposit — as well as the checklist is growing.

J.P. Morgan Mind-Brought Investing venture

Nevertheless the Economic Advancement and you will Tech to the twenty-first Millennium Act, or FIT21, and this enacted the house just before dying regarding the Senate last year, is a good book. Regulations is actually the subject of extreme lobbying by the crypto supporters with massive amounts on the line and money to pay, as well as $170 million to your 2024 election. And also the conventional economic locations may come to appear a lot more like the fresh crypto locations—wilder, reduced transparent, and much more unstable, that have trillion-dollars outcomes stretching years to come.

It doesn’t matter how terrifying the information otherwise brief-term forecasts may seem, some time perspective haven’t assist investors down. It features the newest diary duration of all bear and you can bull field in the S&P five hundred dating back to the start of the nice Anxiety within the Sep 1929. Just what you can note is the fact that the mediocre amount of bull places (step one,011 calendar days) on the S&P five hundred is roughly step three.five times longer than an average S&P 500 bear market (286 diary days). To possess nine ages, M2 currency have has been growing with no interruption.

Garten as well as appeared to strongly recommend, nonsensically, those funds owed in order to people in Trump’s clubs should not be as part of the tally because the Trump will pay them back that have coming income. President Biden ended America’s longest combat, bringing the troops house out of Afghanistan and you will assisting the brand new resettlement from more 120,100000 Afghan people as well as their household in the usa, the greatest resettlement effort since the Vietnam Battle. Plus the brand new wake from Russia’s attack away from Ukraine, the us rallied the country to address a global dining crisis and you may provided $2 billion inside the around the world humanitarian assistance. Trump are the initial Chairman of one’s Us to leave office that have less work within his Administration than just as he became President. Instead of Biden, whoever focused tariffs to the China often give You.S. development, Trump’s plan to increase taxes to the imports away from allies, including European cancer medications and you may dishes out of Mexico and you can Latin America, have a tendency to slip hard to the American families. Trump has constantly failed to assist American professionals as the they have usually put himself basic.

The woman group is in charge of managing analysis on the part of the fresh bank’s money and you may wealth-management organizations as well as its organization ties tool. Professionals across Blackstone can publish data files for example private information about particular product sales and macroeconomic search away from money banking companies and consulting organizations. The idea is actually for personnel to inquire about DocAI to possess advice in this the individuals files and also for the equipment so you can up coming find and you may overview they. Dependent by hedge fund’s Applied AI group, Deep Lookup assists experts and collection managers respond to cutting-edge look issues. The brand new tool draws inside the facts from about 5 million files, such as regulating filings, income transcripts, third-team research and market research, and Balyasny’s inner analyses and you can memos. Mainly used by money communities, Strong Research facilitate experts and you can PMs look carries prior to making an excellent exchange and you will gauge the impact out of international industry events to the a great collection otherwise group of stocks.

The brand new center purpose of a financial investment banking corporation—produced in effortless words—is always to render consultative services on the part of a customer, similar to that a bona fide property representative. In a nutshell, the brand new role of a financial investment banker is to hook up consumers and you can sellers which have coinciding interests, negotiate the fresh terms of the order design, and you may do the deal procedure. Because of this, the fresh demand for therefore-called safe assets powered the newest 100 percent free disperse from investment on the housing in america. It considerably worsened the newest crisis while the financial institutions or any other loan providers have been incentivized to help you thing much more mortgage loans than before. Dai are a good crypto-collateralized stablecoin whoever issuance are ruled by a great decentralized independent business (DAO) called MakerDao and you will implemented because of wise deals.

We will continue committing to public safety measures, including resiliency and you will air conditioning facilities, thus people, along with the really insecure citizens, are able to find retreat while in the extreme environment situations. And you may we have been taking care of pros, whom often risk their life practical inside high weather, which have Chairman Biden such launching the original federal temperatures standards to protect experts out of dangerous temperature just last year. The fact is that both Public Defense and you may Medicare come in a more powerful financial position today than simply when Chairman Biden got work environment. All of our solid monetary recovery features aided to give Medicare solvency because of the a decade.

Son Yorumlar